In this guide

For the third year running, investors had a surprisingly good year in 2025 thanks to moderating inflation, lower interest rates, economic growth and buoyant share markets.

Despite escalating geopolitical tensions in the Middle East and Ukraine, continuing cost-of-living pressures and fears an artificial intelligence (AI)-driven bubble was about to burst, shares streaked ahead. And as the table below shows, most major asset classes produced positive returns.

But the shooting star award for 2025 goes to gold and precious metals, thanks to the same list of geopolitical and market uncertainties.

The previous year’s stellar performer, Bitcoin and other cryptocurrencies, plummeted despite the backing of newly minted US President, Donald Trump. As the saying goes, the higher they jump, the harder they fall.

Against this backdrop, super funds had another excellent year. Ratings group SuperRatings estimates the median Balanced option (60-76% growth assets, similar to Chant West’s Growth option) delivered a return of 9.1% to members over 2025.

Retirees did even better, with members of pension funds achieving returns of around 10%.

It’s an impressive result for super fund members and investors generally. Given the wall of worries they scaled over the course of the year, it’s further vindication that holding your nerve and focusing on long-term financial objectives pays off.

Calendar year returns to 31 December (% change)

| 2024 | 2025 | |

| Shares | ||

| S&P 500 | +24.2% | +16.6% |

| ASX 200 | +7.5% | +6.8% |

| Interest rates / Bond yields | ||

| Cash rate | 4.35% | 3.60% |

| Australian 10-year bond yield | +0.4% | +0.4% |

| US 10-year bond yield | +0.6% | -0.4% |

| Currency | ||

| $A vs $US | -9.1% | +7.8% |

| Commodities | ||

| Iron Ore | -23.0% | +3.4% |

| Oil (Brent Crude) | -2.9% | -19.9% |

| Gold | +27.4.3% | +64.5% |

| Australian residential property | ||

| Cotality Home Value Index | +4.9%% | +8.6% |

Sources: Trading Economics, Reserve Bank of Australia (RBA), Australian Bureau of Statistics (ABS), Cotality

The big picture

The Australian economy strengthened in 2025, driven by household consumption, private investment and government spending on health, education and infrastructure projects.

In the year to September, (the latest available, see graph below) Australia’s economy grew by 2.1%, a marked improvement on the previous year’s anaemic 0.8% rise. This was helped by our major trading partner China’s steady 4.8% growth. China’s trade surplus with the world continues apace, despite Donald Trump’s tariffs and a sluggish domestic economy.

In the US, still the world’s largest economy, economic growth was a healthy 2.3% in the year to September despite concerns about the impact of Trump’s tariffs on inflation.

Inflation eases but not tamed

The main bugbear for investors and investment markets was and is inflation. While inflation, interest rates and bond yields moderated in 2025, there are concerns that inflation is not dead yet.

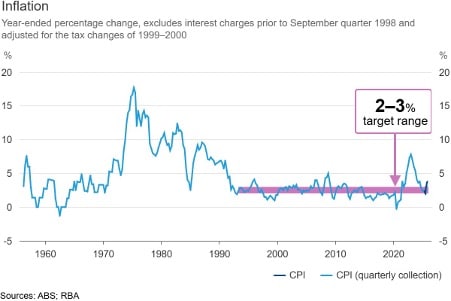

Graph: Australian inflation

The Reserve Bank of Australia (RBA) cut the official cash rate three times in 2025, from 4.35% to 3.60%. But expectations of further rate cuts were dashed by a jump in inflation to 3.8% in the year to October, well above the RBA’s target range of 2-3%. Unless and until inflation is tamed there are growing concerns that the next move in interest rates could be up.

The RBA is one of many central banks to have eased official interest rates in 2025. In the US, the Federal Reserve cut rates three times to finish the year at a range of 3.5-3.75%, taking borrowing costs to their lowest rate since 2022. While the inflation rate there has fallen to 2.7%, the US Fed, like central banks everywhere, is on high alert for signs of resurgent inflation.

Widespread interest rate cuts also produced a fall in bond yields, although Australia was the exception as the 10-year government bond yield lifted slightly to 4.7%. In the US, the yield on 10-year government bonds fell to 4.2%. As yields fall, bond prices rise which increases bond returns for investors.

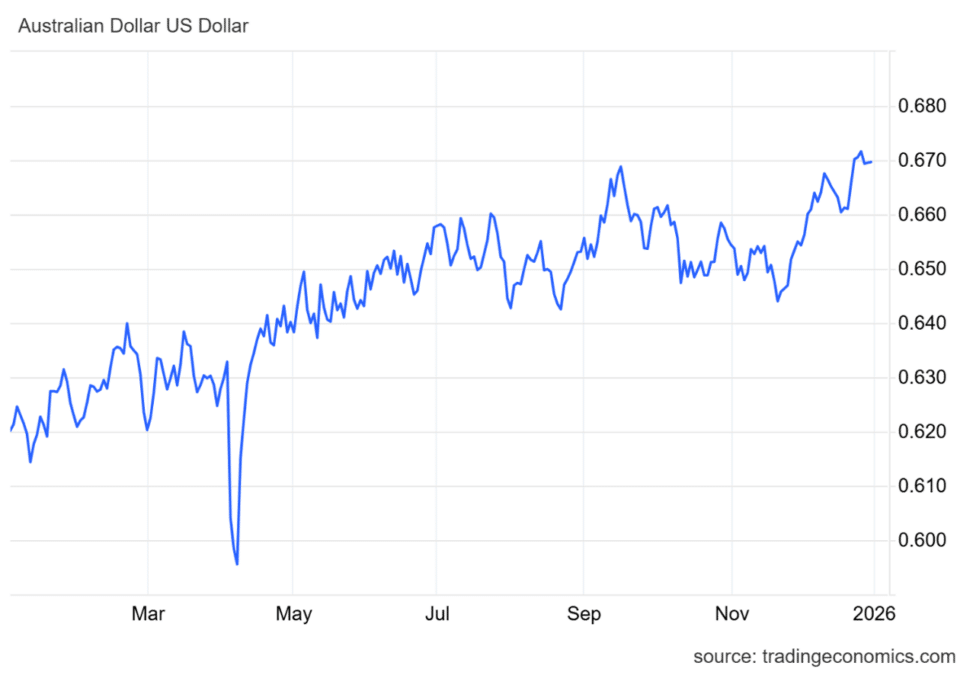

Falling US bond yields and a widening interest rate differential resulted in a weaker US dollar, with the US dollar index down 9% against a basket of currencies. The Aussie dollar rose 7.8% on US dollar weakness, to close the year at 66.7 US cents.

2026 SMSF calendar

"*" indicates required fields

Graph: Australian dollar to US dollar

Shares surge

Global share markets rode waves of uncertainty in 2025, falling 17% on Trump’s tariff turmoil in April only to rise from the dead as Trump backed down, a global trade war was averted, and AI euphoria took hold.

The US market was the main driver of returns for diversified investors, with the broad S&P 500 Index up 16.6% to close near its record high. The Nasdaq 100 Index was up 20.3% on enthusiasm for AI and tech giants. The Nasdaq is home to the top 100 technology stocks, most notably Nvidia, the company at the centre of the AI boom. Since its low in 2022, Nvidia’s share price is up 1,476%! (That’s not a buy or sell recommendation, simply a remarkable trajectory and a sign of the times.)

The US market was also helped by the succession of rate cuts and strong economic growth. While there are growing concerns about a share market bubble, history has shown that falling inflation and interest rates coupled with economic growth are a boon for shares.

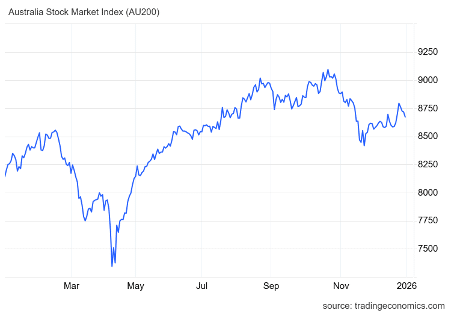

Australian shares lagged the US and most major world markets, with indexes in Japan, the UK, Germany, Hong Kong and Canada all climbing more than 20%. Still, the local market managed a solid performance, up 6.8%. The lack of locally listed technology stocks and poor profits weighed on market sentiment as talk turned to interest rate rises.

Graph: ASX 200 Index

When dividends are added, the total return from Australian shares was a healthy 10.3% (as measured by the ASX 200 Accumulation Index).

A gold-plated year for commodities

The price of Australia’s major export earner, iron ore, rose marginally in 2025, up 3.4% to US$107.13 a tonne on steady demand from China.

The big commodity story in 2025 was precious metals. Gold was up 65% for back-to-back annual gains. Gold fever took to the streets, as thousands of mainly younger investors queued in central Sydney to buy the precious metal.

Gold hit record highs as central banks began cutting interest rates and geopolitical tensions in Ukraine and the Middle East intensified. Gold is traditionally viewed as a safe haven asset in times of political and economic turmoil. Fears of a share market bubble may also be driving the flight to safety.

But even gold’s stellar gains were outshone by silver, up a stratospheric 147%, and platinum, up 130%. Both have starring roles in high tech manufacturing – silver in electronics and solar panels, platinum in automotive catalytic converters, advanced medical devices and defense.

Even so, increases in gold and rural commodity prices were more than offset by lower thermal coal, alumina, and liquified natural gas prices. The Reserve Bank’s commodity index fell by 4.1% in Australian dollar terms.

Fears of an oil shock failed to eventuate, despite the ongoing conflict in Ukraine and the Middle East and Donald Trump’s war on Venezuela, a major oil producer. The price of Brent Crude fell for the third consecutive year, down almost 20% to US$60.85 a barrel.

Although bad for the oil and gas sector, lower oil prices are good news for motorists who haven’t yet made the switch to an electric vehicle, and market sectors heavily dependent on fossil fuel.

Strong Australian housing market

Australia’s residential home values rose 8.6% in 2025 for a total return of 12.4% when rental income is included, according to property analysis group Cotality.

But signs emerged of a softer market in December on concerns that interest rate cuts may be over and the next move from the RBA could be a rate hike. That, and ongoing cost-of-living pressures and affordability issues suggest slower growth in the year ahead, although a lack of new housing should put a floor under property values.

As the table below shows, prices vary enormously across the country. Every capital city recorded price growth over the year, topped by Darwin (up 18.9%) with Melbourne bringing up the rear (4.8%). Total returns from price growth and rental income were also strongest in Darwin at a staggering 26.9%, albeit on a low median price of $586,912.

Sydney still has the highest median home value of $1,280,613, followed by Brisbane.

Regional price growth of 9.7% outstripped capital cities (8.2%), while entry level housing experienced a higher rate of growth than prestige property. In both cases, affordability was the driver.

CoreLogic Home Value Index as at 31 December 2025

| Annual | Total return | Median value | |

| Sydney | 5.8% | 9.0% | $1,280,613 |

| Melbourne | 4.8% | 8.5% | $827,117 |

| Brisbane | 14.5% | 18.3% | $1,036,323 |

| Adelaide | 8.8% | 12.7% | $902,249 |

| Perth | 15.9% | 20.7% | $940,635 |

| Hobart | 6.8% | 11.3% | $720,341 |

| Darwin | 18.9% | 26.9% | $586,912 |

| Canberra | 4.9% | 9.2% | $893,907 |

| Combined capitals | 8.2% | 11.8% | $991,331 |

| Combined regional | 9.7% | 14.7% | $734,351 |

| National | 8.6% | 12.4% | $901,257 |

Source: Cotality

The road ahead

So here we are again, on the brink of a new year in an increasingly uncertain world. As we’ve seen in recent years, uncertainty can deliver surprisingly good investment returns. But worries persist.

Each year, veteran economist and market analyst Don Stammer releases what he calls the X-Factor for the year ahead. The thing that could move markets, for better or worse. His pick for 2026 is a combination of higher interest rates in many countries, including Australia, to offset the impact of huge budget deficits on inflation; and elevated geopolitical risks (the worst since World War II) with asset prices near historic highs.

After such a strong performance over several years, share valuations look stretched. The boom in AI stocks is viewed by some as a sign of overconfidence, along with rapid investment in data centres funded by debt.

After a series of rapid rate cuts by central banks, interest rates may be close to the bottom of the cycle and could be ratcheted up again if inflation rises.

While the worst fears about the impact of Trump’s tariffs and other disruptive policies did not eventuate, uncertainty about their long-term impact persists. A slowing jobs market in the US and an ongoing property slump in China could drag down the global economy.

Geopolitical tensions in Ukraine and the Middle East show few signs of easing, and US tensions with China simmer. The US mid-term elections in 2026 are also a reliable harbinger of share market volatility.

In Australia, all eyes will be on the next inflation reading and the RBA’s response. Markets are anticipating two rate hikes this year, which could dampen consumer sentiment and residential property prices (which would be applauded by first home buyers).

If the last few years have taught us anything, it’s to expect the unexpected. One thing we can predict with some certainty, though, is that market volatility and uncertainty are likely to persist in 2026.

The new year is a good time to check your asset allocation and rebalance where appropriate. If, for example, surging share prices have lifted your allocation to shares from beyond the range specified in your investment strategy, then it may be time to take some profits and reallocate the proceeds to other asset classes.

As always, investors with a diversified portfolio tailored to their needs, who maintain a long-term focus and stay the course, are likely to weather whatever conditions come their way.

Leave a Reply

You must be logged in to post a comment.